Decision-makers who receive a traffic light for support really don’t have anything more to decide. The report author already made the judgment call. Worse yet, decision-makers don’t even have the opportunity to try to understand it. Fortunately, the situation is anything but hopeless.

We have already warned our readers about the dangers of exception reporting, which uses rigid thresholds and presents variances in the form of traffic lights. The recent downfall of Sachsen LB just goes to prove that this danger is present and real.

Nevertheless, there is nothing wrong with automating the time-consuming routine task of distributing information when a certain event – in the simplest case, a period closing – has taken place.

On the other hand, reports should be so interesting that consumers would never even dream of wanting to receive less of them in the first place. Good reports arouse consumers to think even when they don’t describe end-of-the-world scenarios. This means the numbers should filter a message, should be sorted and can be highlighted – provided that the selected criteria are reasonable. A traffic light is no substitution for numbers. If there is enough space for one, there is enough room for the underlying value as well. Otherwise, we would have the same story with rigid thresholds and the fiction of a manager who has nothing to do all day unless a crisis breaks out.

Simple yet effective: sorting

The simplest valuation is sorting the different values. Sort your values whenever possible – apart from two exceptions. Don’t sort names in alphabetical order (remember ‘Austria first’) and don’t change schemes that would be illogical if the order were changed (e.g. breakeven analysis). Through analytic methods such as multidimensional ranking, we can compare and contrast many different perspectives (customers, products, regions, etc.) at the same time.

Sophisticated but usually an insider secret: weighted variance

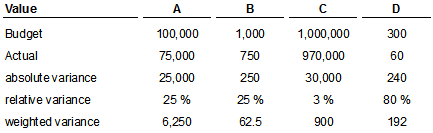

Traffic lights work with either relative or absolute values. If you are working with different scales, however, that causes a problem. You can deal with small percent variances if you are talking about billions of dollars and you don’t really feel large percent variances when you are working with small numbers. On the other hand, while the CXO of a large pharmaceutical corporation certainly won’t notice a $10,000 variance in monthly sales, the sales representative for a certain region definitely would. In this case, you can weigh the relative and absolute variance against each other by multiplying both variance values. To understand the effects, simply sort them based on their absolute and relative size as well as their weighed variance alternatively in columns A through D of the following table.

The weighted variance is the only figure that correctly assesses if the variance is relevant or not.

Next time, we will take a look at a few methods that are even more sophisticated – but even easier to explain!